CDMA Tax Online Payment: Pay for Property, Water, Trade etc., Check Status @cdma.ap.gov.in & commercial property located in the state…

Andhra Pradesh State Government collects Property Tax from citizens every 6months or Yearly from their citizens owning property (Land, House or any such equivalent), and the AP property tax is calculated based on Annual Rental Value and Tax Rate fixed by the corporation of property.

The percentage of the house tax rate will change based on the location of urban bodies which will be calculated to measure the area of land or property, and thus a clear calculation of Property Tax for that month can be found on the official website or from the receipt received while payment.

AP Property Tax

This is a one-time compulsory payment to be done by every property owner once in 6months or for a year, and the property tax bill is different for Agriculture or Industrial tax mentioned, and there are multiple payment platforms launched to pay Andhra Pradesh property tax to clear current dues, Let’s check as below

| Si.No | Payment Platform |

|---|---|

| 1 | cdma.ap.gov.in |

| 2 | UB Counter |

| 3 | Meeseva Counter |

| 4 | AP Online |

| 5 | Puraseva App |

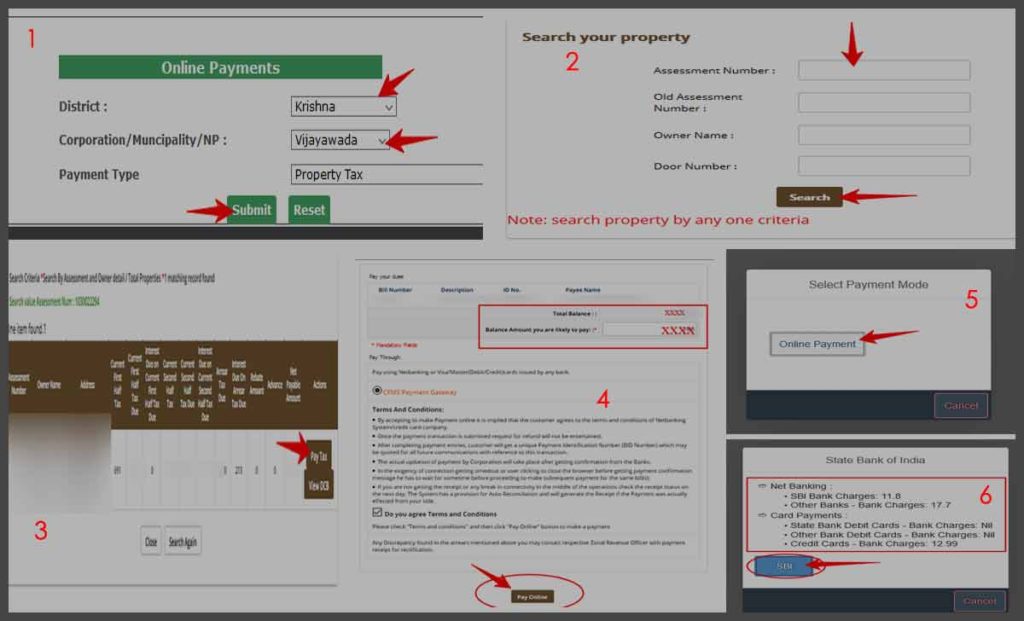

The below is the step by step online new process for Andhra Pradesh property tax payment through a web portal, so without wasting time let’s watch the house tax bill payment process

AP Property Tax Online Payment

- Open cdma.ap.gov.in web portal on your browser or Click Here To Go Direct Link

- Hover to Online Payments

- Click on Property Tax

- Drill down and Select District, Corporation / Muncipality / Np and Payment Type

- Click Submit

- Enter your 10 digit Assessment Number and Click Search

- Click on Pay Tax at right side

- Enter the amount to pay in the column provided (Balance amount you are likely to pay)

- Select CFMS Payment Gateway

- Scroll down and Accept the Terms Conditions

- Click Pay Online

- Click Online Payment

- Find the Charges for various modes (Net Banking, Debit / Credit Card)

- Click SBI

- Select your payment source from different options and complete your payment with your secured credentials.

How to change my Name in AP Property Tax Bill?

If you found to change your name based on the current generated Property Tax payment slip, then you need to visit the nearest municipal / corporation office with your receipt, Sale deed having correct name on property, No Objection Certificate and an Application form, and this will be taken by the department through AP Online and will be proceeded in 15 working days.

Does Property tax Collected on Empty Land in AP?

Yes, as per the rules and regulation if any land is owned by anyone without being under the agriculture category in Andhra Pradesh, the property tax will be calculated with less percent value and one can get detailed information from their local municipality with the current Andhra Pradesh Property Tax payment receipt.

As Content Writer, I take on leadership within our content creation team, overseeing the development of error-free educational content. My primary responsibility is to produce and analyse high-quality content educating and informing the aspirants about upcoming government exams published on our website. I have more than 6 years experience in content writing wherein 3.5 years of experience