Short Info: अटल पेंशन योजना आवेदन फॉर्म Atal Pension Yojana List 2020 [Status] – [Apply Online] Atal Pension Yojana (APY) SBI PNB 2021 – APY Scheme Apply Online, Chart Pension Status, Online Registration, Application Form, Eligibility, Features, Benefits and Check Online Application Status at Official Website http://www.pfrda.org.in/.

| Short Scheme Details |

| Name of Scheme: Atal Pension YojanaApplication Status: ActiveScheme Benefit: Pension |

From now on, Atal Pension Yojana (APY) subscribers can increase or decrease the pension amount under the scheme any time during the year. The Pension Fund Regulatory and Development Authority (PFRDA) has asked all banks to process upgrade/downgrade of pension amount requests of APY subscribers throughout the year with effect from July 1, 2020.

Subscribers can update pension amount once in a year. Earlier this facility was available only during the month of April year.

पेंशन कोष नियामक एवं विकास प्राधिकरण (पीएफआरडीए) ने एक विज्ञप्ति में कहा, ‘इस व्यवस्था से एपीवाई अंशधारक अपनी आय और एपीवाई योगदान देने की क्षमता में बदलाव के अनुसार योगदान राशि को घटा/बढ़ा सकेंगे। यह 60 साल तक योजना में योगदान बनाये रखने के लिये जरूरी है।’

Atal Pension Yojana 2021 Apply Online

Atal Pension Yojana (or APY, previously known as Swavalamban Yojana) is a government-backed pension scheme in India, primarily targeted at the unorganised sector. It was mentioned in the 2015 Budget speech by the then Finance Minister Arun Jaitley. It was launched by Prime Minister Narendra Modi on 9 May in Kolkata.

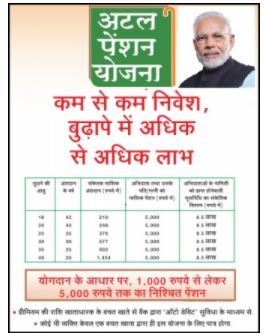

Under Atal Pension scheme, a guaranteed minimum monthly pension of Rs.1000/-, Rs.2000/-, Rs.3000/-, Rs.4000/- and Rs.5000/- will be provided to the subscribers on the basis of the contribution made by them. Atal Pension is launched with an aim to provide retirement benefits to the workers in the unorganized sectors. On contributing to this scheme, they can save their retirement.

All Candidates who are willing to apply online application then download official notification and read all eligibility criteria and application process carefully. We will provide short information about “Atal Pension Yojana 2021” like Scheme Benefit, Eligibility Criteria, Key Features of Scheme, Application Status, Application process and more.

| Atal Pension Yojana 2021 – Overview | |

| Name of Scheme | Atal Pension Yojana (APY) |

| in Language | अटल पेंशन योजना |

| Launched by | By the central government |

| Administered by | Pension Fund Regulatory and Development Authority (PFRDA) |

| Population covered | Unorganized sector |

| Beneficiaries | A citizen of India. |

| Major Benefit | Pension Scheme |

| Scheme Objective | Giving a sense of security |

| Scheme under | Central Government |

| Name of State | All India |

| Post Category | Scheme/ Yojana |

| Official Website | http://www.pfrda.org.in/ |

| Important Dates | |

| Event | Dates |

| Launched | Year 2015 |

| Last Date to Apply Online | NA |

| Important Links | |

| Event | Links |

| APY Brochure | Click Here |

| APY Subscriber Information Brochure in Hindi/English | Click Here |

| APY Scheme Details | Click Here |

| APY – Contribution Chart | Click Here |

| Atal Pension Yojana 2021 | Official Website |

Can now contribute according to the capacity

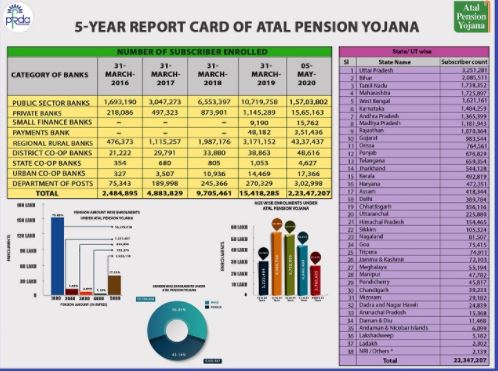

In this regard, the Pension Fund Regulatory Authority (PFRDA) said that it is necessary to maintain the contribution of shareholders to the scheme for 60 years. Due to this, the rules have been changed so that the shareholders can decrease or increase their contribution according to their income and capacity. Explain that about 2.28 crore shareholders are registered under the Atal Pension Yojana.

Auto-debit of APY contributions

Apart from the above, from July 1, 2020 auto-debit of APY contributions has also started, which was stopped till June 30, 2020 due to PFRDA’s circular issued on 11th April, 2020.

Apply Online: How to avail the benefits of the scheme?

If you also want to take advantage of this Atal Pension Yojana, then say that after 60 years, you will have to pay Rs 42 per month for 20 years to avail the monthly pension of Rs 1,000. If you want to take 5000 rupees as pension then you have to pay 210 rupees till the age of 60 years. If you are 40 years old, then you will have to deposit Rs 291 for a pension of Rs 1,000 and Rs 1,454 for a pension of 5 thousand.

For those who have a bank account but do not use the net banking facility, opening an Atal Pension Yojana (APY) account will soon become easier. To simplify the on-boarding process of APY subscribers, the Pension Fund Regulatory and Development Authority (PFRDA) is allowing APY-POP to start an alternate channel for on-boarding of their existing savings account holders. Under the new channel one can open APY account without using net banking or mobile app.

Step to Apply Online Atal Pension Yojana 2021

Step 1- Interested people who want to apply under the Prime Minister Atal Pension Yojana are the first to open their savings account in any national bank

Step 2- After that fill all the information asked in the application form for the Prime Minister Atal Pension Yojana like Aadhar card, mobile number etc.

Step 3- After filling the application form, submit it to the bank manager. After this, all your letters will be verified and your bank account will be opened under Atal Pension Yojana.

Modification of Subscriber Details under APY

Subscriber will have to fill the desired changes in APY Subscriber modification form and submit the same to the APY-SP branch along with the required documents for modification of personal information like address, phone number, etc. The form can be downloaded online from

https://www.npscra.nsdl.co.in/nsdl-forms.php

Change in frequency of contribution e.g. from quarterly contribution to monthly contribution or from half yearly contribution to quarterly contribution etc. may be done after submission of written request by the APY subscriber to the APY-SP branch.

Important information for subscriber:

Discontinuation of payments of contribution amount shall lead to following:

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount.

PRAN, Transaction Statements and Contribution Under APY

- Transaction statement and PRAN Card can be viewed and printed anytime, from anywhere and free of cost by visiting www.npscra.nsdl.co.in>> Home>>Atal

- pension Yojana>> APY e-PRAN/Transaction statement view.

- Subscriber can request for issuance of Physical PRAN card after paying the requisite sum at the website https://enps.nsdl.com/eNPS/APYRePrintPRAN.html>>Atal Pension Yojana>>Print APY PRAN Card,

- After enrolling into Atal Pension Yojana, Physical transaction statement will be sent once in a year to the registered address i.e. the address provided by a subscriber after enrolling for Atal Pension Yojana.

- All the queries regarding APY account / contribution should be made to the APY-SP branch only or through CGMS.

- Information about the status of contributions will be communicated by CRA-NSDL through periodic SMS alerts on registered mobile number of the subscriber

Important Document

Required Document to Apply Online

- Applicant’s Aadhar Card

- Mobile number

- Identity card

- Proof of permanent address

- Passport size photo

Eligibility Criteria

Beneficiary Guidelines

- The minimum eligible age for a person joining APY is 18 years and the maximum is 40 years.

- An enrolled person would start receiving pension on attaining the age of 60 years. Therefore, a minimum period of contribution by the subscriber under APY would be 20 years or more.

- Applicant should have bank account and bank account should be linked to Aadhar card.

- Aadhaar will be the primary KYC. Aadhar and mobile number are recommended to be obtained from subscribers for the ease of operation of the scheme. If not available at the time of registration, Aadhar details may also be submitted later stage.

Who is not eligible to get government co-ordination under APY?

The beneficiaries of any statutory social security schemes are not eligible to receive the benefit of government co-contribution under APY. Below, we have shared some of the Acts, for which government coordination has not been provided-

- The Employees Provident Fund and Miscellaneous Provisions Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provisions Act, 1948.

- Simmons Provident Fund Act, 1966

- Assam Tea Garden Provident Fund and Miscellaneous Provisions, 1955.

- Jammu and Kashmir Employees Provident Fund and Miscellaneous Provisions Act, 1961.

- Any other statutory social security scheme.

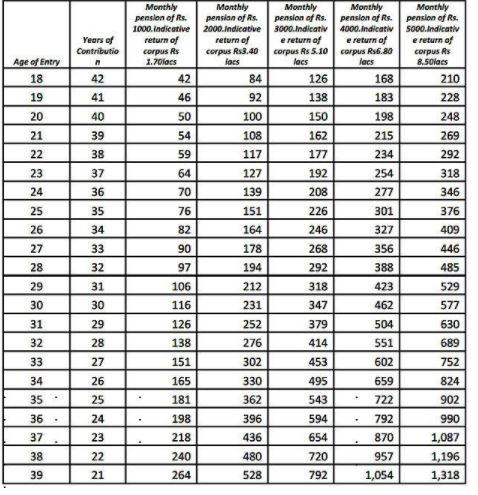

- APY Contribution Chart

Major Benefits

Beneficiary Benefits

Fixed pension for the subscribers ranging between Rs. 1000 to Rs. 5000, if he joins and contributes between the age of 18 years and 40 years. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Key Features of Scheme

Scheme Feature

- The amount collected under APY are managed by Pension Funds appointed by PFRDA as per the investment pattern specified by the Government. The subscriber has no option to choose either the investment pattern or Pension Fund.

- Periodical information to the subscribers regarding balance in the account, contribution credits etc. will be intimated to APY subscribers by way of SMS alerts.

- Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the guaranteed monthly pension.

- APY module will raise demand on the due date and continue to raise demand till the amount is recovered from the subscriber’s account.

APY Scheme Contribution Chart : Monthly Contributions

The monthly contribution depends upon the amount of pension you want to receive upon retirement and also the age at which you start contributing. The following table tells you how much you need to contribute per annum based on your age and pension plan.

APY Mobile Application

APY mobile application is available for APY users free of cost, where, recent 5 contributions can be checked and transaction statement and e-PRAN can also be downloaded anytime without paying any charge. Android users can download APY mobile application from Google play store by typing ‘APY and NPS Lite’ in search option.

Raising Grievance Under APY

- Subscriber can anytime raise grievance free of cost and from anywhere by visiting: www.npscra.nsdl.co.in >>Home >> select: NPS-Lite or through CGMS

- Subscriber raising the grievance will be allotted a token number against the grievance raised. Subscriber may check the status of the grievance under “Check the status of Grievance / Enquiry already registered”.

News Source: https://economictimes.indiatimes.com/wealth/invest/atal-pension-yojana-now-you-can-change-pension-amount-anytime-during-the-year/articleshow/76811562.cms, https://www.india.com/hindi-news/business-hindi/atal-pension-yojna-2020-latest-news-central-government-change-rules-now-you-can-change-your-pension-amount-pfrda-bank-4077785/,

As Content Writer, I take on leadership within our content creation team, overseeing the development of error-free educational content. My primary responsibility is to produce and analyse high-quality content educating and informing the aspirants about upcoming government exams published on our website. I have more than 6 years experience in content writing wherein 3.5 years of experience